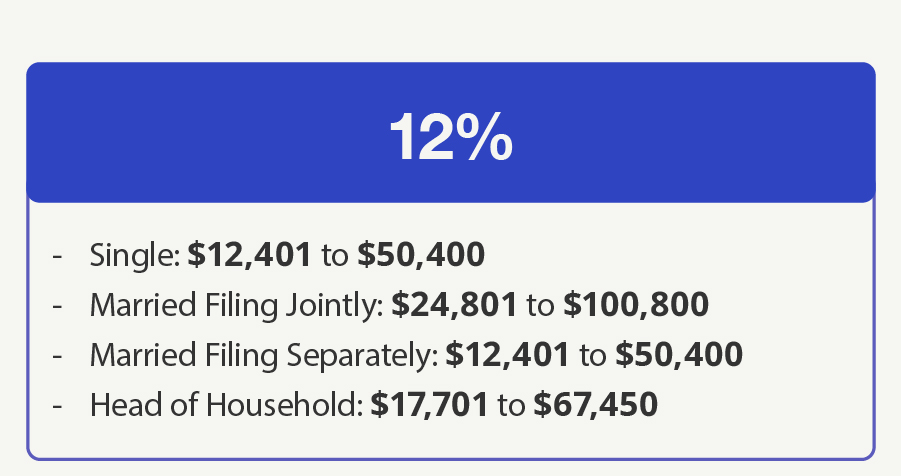

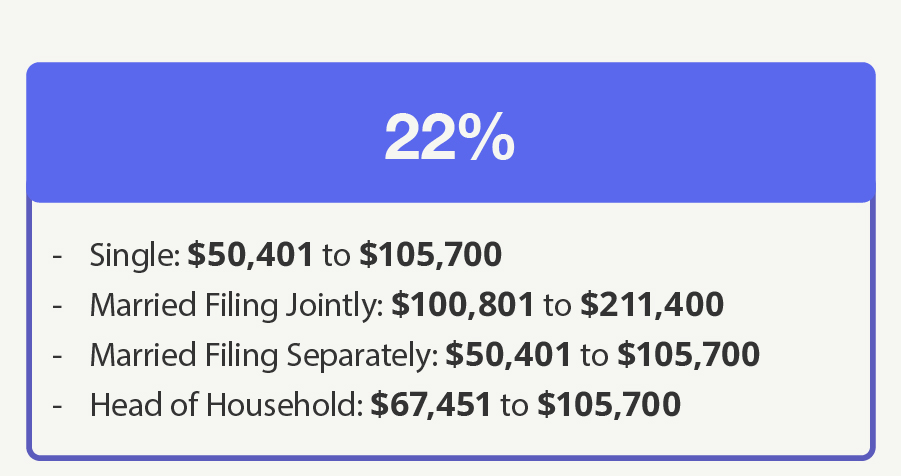

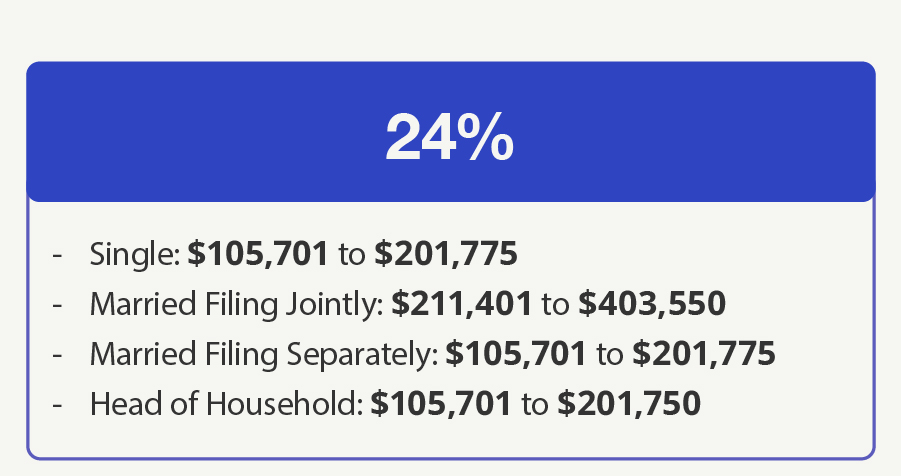

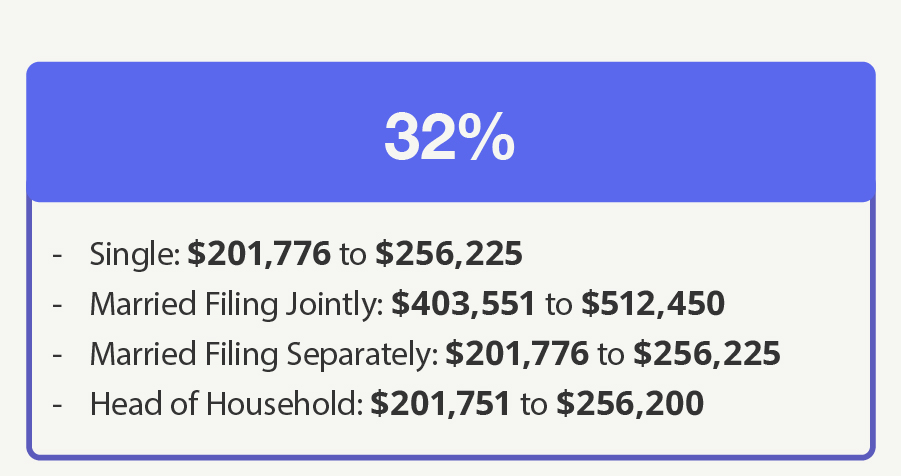

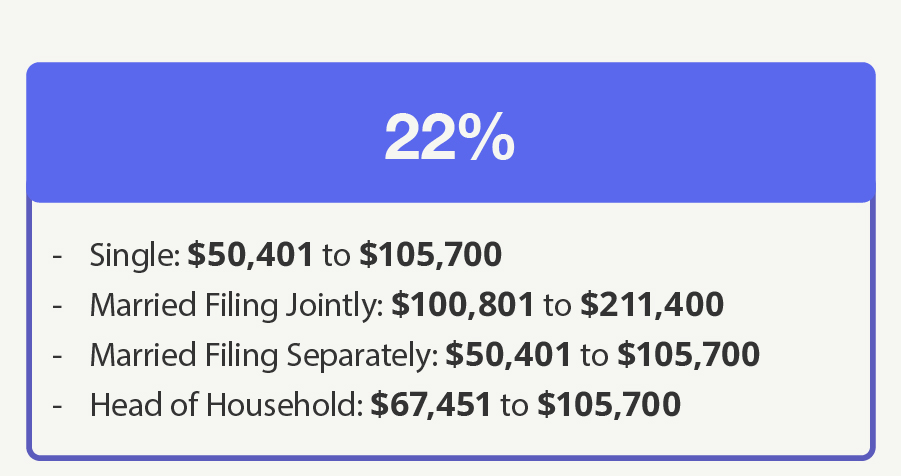

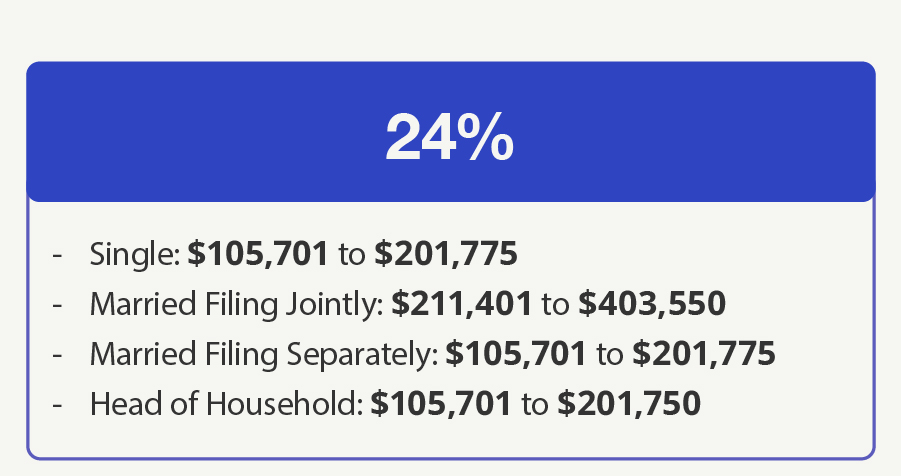

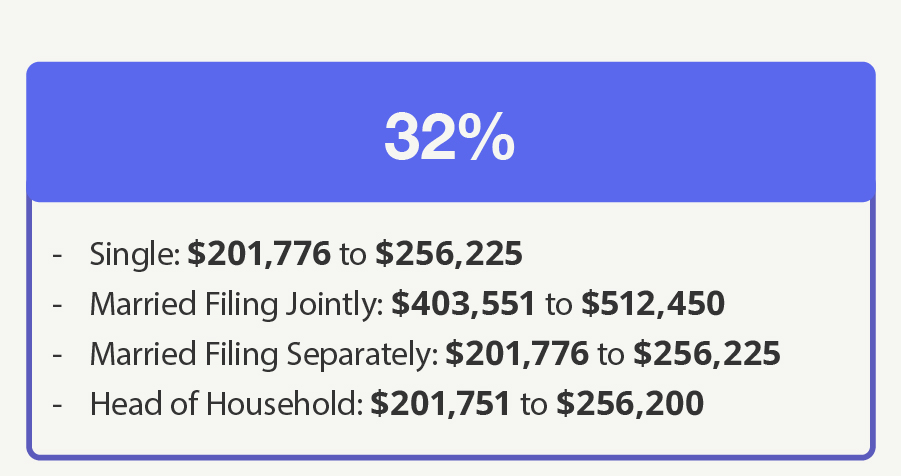

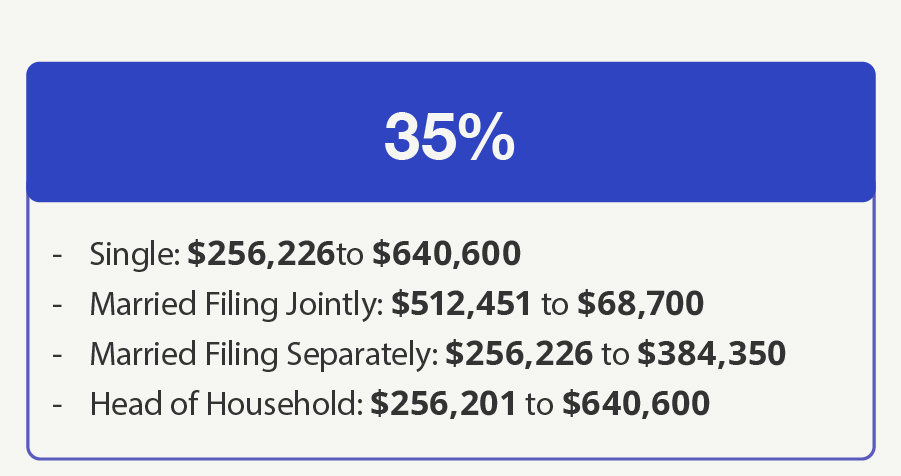

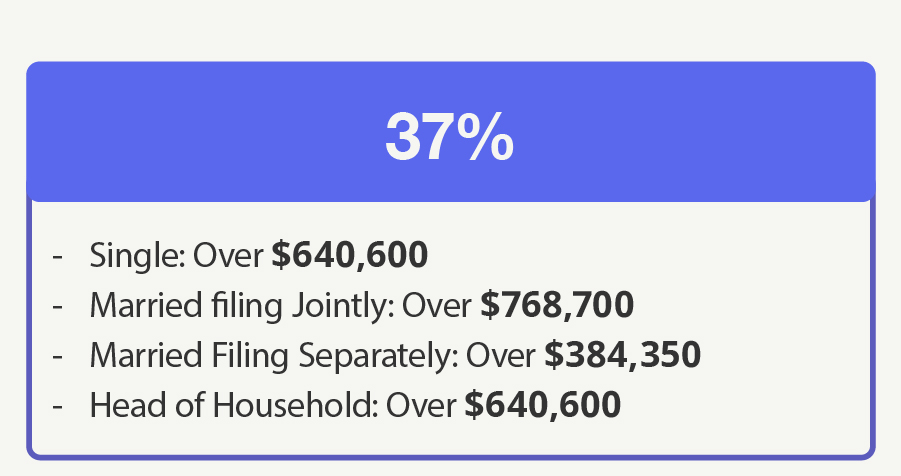

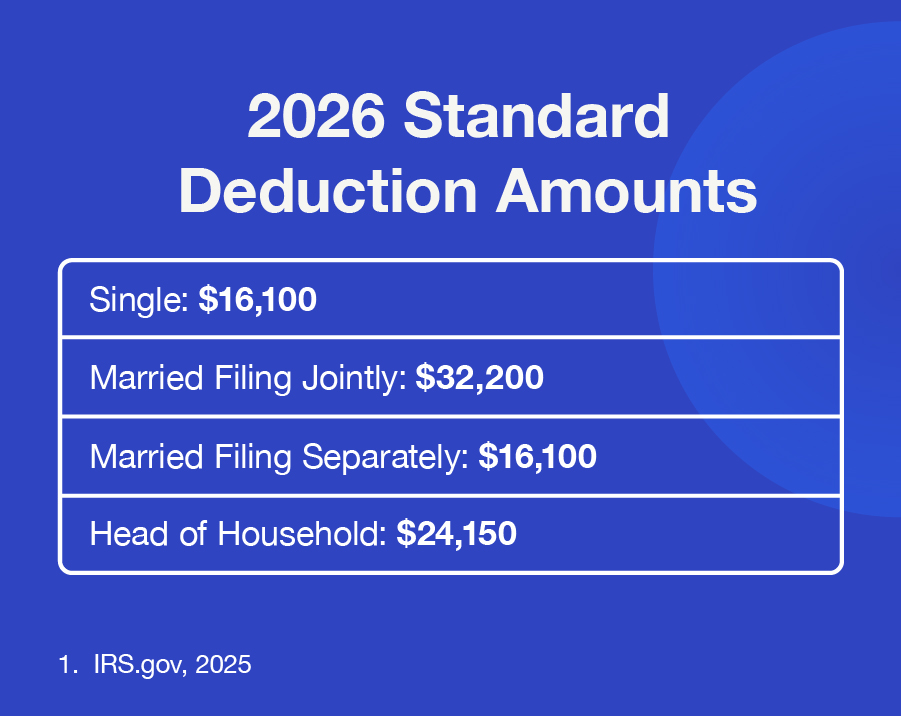

What's My 2026 Tax Bracket?

Exchange-traded funds have some things in common with mutual funds, but there are differences, too.

This article may help you maximize the benefits of your donation for your chosen charity.

Retiring earlier than expected can be disheartening. Learn steps that can help you smoothe the road ahead.